Can You Add To An Online Savings Account Regularly

Learning Bank - Checking & Savings Accounts

People by and large use checking accounts to shop money in the brusk term until it is needed for 24-hour interval to twenty-four hour period expenses – like gas or groceries – or to pay bills, and they tin can normally deposit or withdraw any amount of money in their account as many times equally they like. Checking accounts also come with convenient ways to deposit and withdraw money from the account, such as checks and ATM cards. However, people with checking accounts must exist careful when using them, since some banks charge fees for certain actions, such every bit using some other depository financial institution's ATM, withdrawing more money from your account than the amount in it, or not maintaining a minimum balance.

On the other mitt, a savings account is used to set money aside for use in the future and allow the money to collect interest. Many people regularly place some of their money into savings accounts rather than spending it in club to achieve fiscal goals, such equally buying the latest gadget or game, without having to go into debt to do it.

Compound interest is involvement paid on both the coin you put into your account and the interest already earned. For instance, if you put $100 into an account that earns 10% interest, you will initially earn $ten, which will result in a total account balance of $110. The side by side time your account earns 10% it will be based on $110 instead of just $100, giving yous a full account remainder of $121.

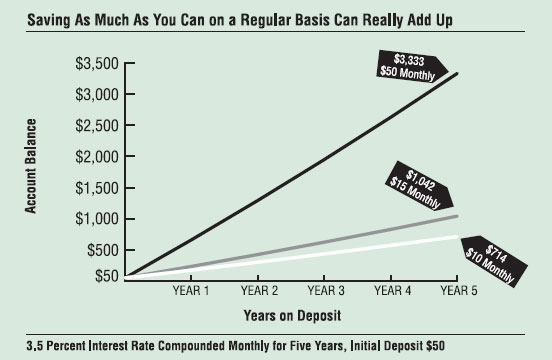

You can earn even more in compound interest if y'all stretch to put as much money as you tin into your account and leave information technology untouched. Encounter the chart below, which is based on a savings account started with $fifty and earning interest at a rate of 3.5% each month. If you add simply $x each month, the account tin grow nicely to $714 after v years. If you instead put in a slightly higher amount—$15 each month—you'd have a rest of $ane,042 later five years. Only if you had increased your deposits to $50 a calendar month, those extra dollars plus the compounding of involvement would requite you a residuum of $3,333 after five years.

There are many banks that offer special accounts for kids and teens, so talk to your parents if you'd similar to open an account of your own and commencement learning how to manage money. But y'all don't need a banking company account to start the habit of saving – a unproblematic piggy bank will do!

Can You Add To An Online Savings Account Regularly,

Source: https://www.fdic.gov/about/learn/learning/accounts.html

Posted by: brinsonthund1953.blogspot.com

0 Response to "Can You Add To An Online Savings Account Regularly"

Post a Comment